Home Building Articles

Home Affordability Gets Squeezed

Article by Lonny Coffey, Affiliated Bank Mortgage

According to the National Association of Home Builders/Wells Fargo Housing Opportunity Index (HOI), nearly 62% of all homes sold nationwide last quarter could be afforded by a family earning the national median income. Two years ago -- when affordability peaked -- 78% of people could afford homes. While mortgage rates are near record lows, home prices are on the rise -- and incomes aren't keeping up. Of course, where you buy makes all the difference. In San Francisco, the median home price is $875,000, making it the least affordable major U.S. city. Only 11.4% of homes sold in San Francisco during the third quarter were reasonably priced enough for the average family to buy, the index found. Other major cities where home prices were out of reach included Los Angeles, Santa Ana, Calif., San Jose and New York. Where home prices were most affordable was predominantly in cities that were hard hit during the recession. In Youngstown, Ohio, for example, nearly 90% of all homes sold last quarter could be comfortably purchased by families earning the local median wage. Syracuse, N.Y., Indianapolis, Ind., Harrisburg, Pa., and Dayton, Ohio, all recorded affordability rates of 84.9% or higher. Despite the growing affordability gap, most buyers are still in a favorable position, said David Crowe, NAHB's chief economist. "Even with nationwide home prices reaching their highest level since the end of 2007, affordability still remains fairly high by historical standards," he said.

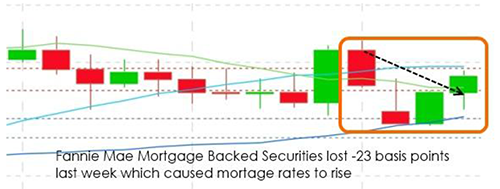

What Happened to Rates Last Week?

Mortgage backed securities (MBS) lost -23 basis points (BPS) from last Friday's close which caused 30 year fixed mortgage rates to move slightly higher from the prior week. We had our best pricing on Monday and our worst pricing on Wednesday.

We had a fairly light week for economic data with a holiday-shortened trading session. Both Wholesale and Business Inventories were slightly better than expected and will help to round out economists projections on the first revision to the fantastic 3rd QTR GDP data.

But the two biggest reports of the week were Retail Sales and Consumer Sentiment which were both better than market expectations. Retail Sales beat estimates (+0.3% vs +0.2%) and Consumer Sentiment rose to its highest levels in seven years which leads economists and traders to speculate that Retail Sales will be even stronger on the next report. Obviously, cheap oil prices at the pump has a lot to do with consumers' upbeat outlook.

Overseas, the Eurozone's growth was stronger than expected and Germany avoided a triple-dip recession which also pressured on our long-bond yields.

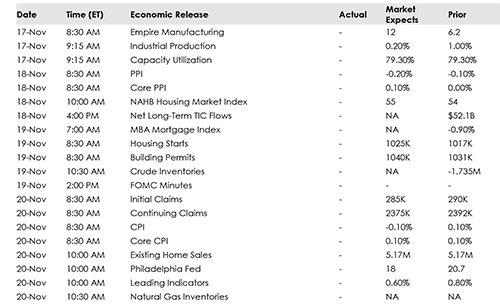

What to Watch Out For This Week:

The above are the major economic reports that will hit the market this week. They each have the ability to affect the pricing of Mortgage Backed Securities and therefore, interest rates for Government and Conventional mortgages. I will be watching these reports closely for you and let you know if there are any big surprises.

It is virtually impossible for you to keep track of what is going on with the economy and other events that can impact the housing and mortgage markets. Just leave it to me, I monitor the live trading of Mortgage Backed Securities which are the only thing government and conventional mortgage rates are based upon.